Are you tired of the hassle of paying taxes through traditional methods? Look no further! The government has made it easier for individuals to pay their taxes using debit or credit cards, as well as digital wallets. In this article, we will explore the benefits and convenience of paying taxes through these modern payment methods.

Introduction to Tax Payment Options

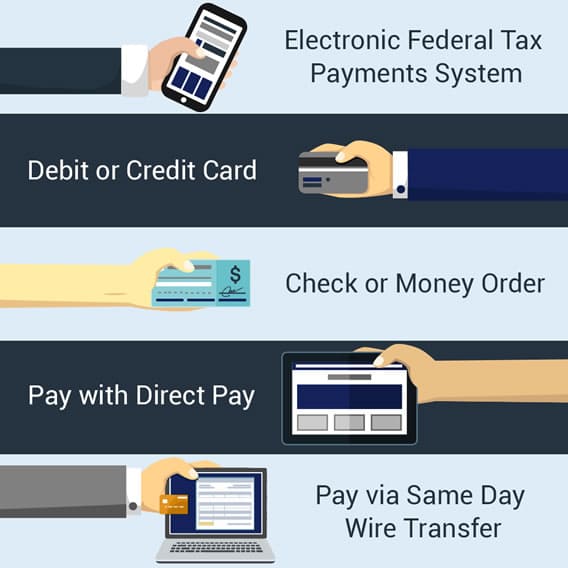

Paying taxes is a necessary part of being a responsible citizen. However, traditional methods of tax payment, such as checks or cash, can be time-consuming and prone to errors. With the advancement of technology, the government has introduced new payment options that make it easier for individuals to pay their taxes on time. Debit, credit, and digital wallet options have revolutionized the way we pay taxes, making it faster, more secure, and more convenient.

Benefits of Paying Taxes by Debit or Credit Card

Paying taxes by debit or credit card offers several benefits, including:

Convenience: Paying taxes online or over the phone is quick and easy, saving you time and effort.

Security: Debit and credit card transactions are secure and protected by robust encryption, reducing the risk of fraud and identity theft.

Flexibility: You can pay your taxes at any time, from anywhere, using your debit or credit card.

Record-keeping: Your payment is recorded automatically, reducing the risk of lost or misplaced receipts.

Digital Wallet Options for Tax Payment

Digital wallets, such as Apple Pay, Google Pay, and PayPal, offer an additional layer of convenience and security for tax payments. These wallets allow you to store your debit or credit card information securely and make payments with just a few clicks. Digital wallets also offer:

Tokenization: Your card information is replaced with a unique token, reducing the risk of data breaches.

Two-factor authentication: An additional layer of security that requires a password or biometric authentication to complete the transaction.

Easy refunds: If you are due a refund, it can be deposited directly into your digital wallet.

How to Pay Taxes by Debit, Credit, or Digital Wallet

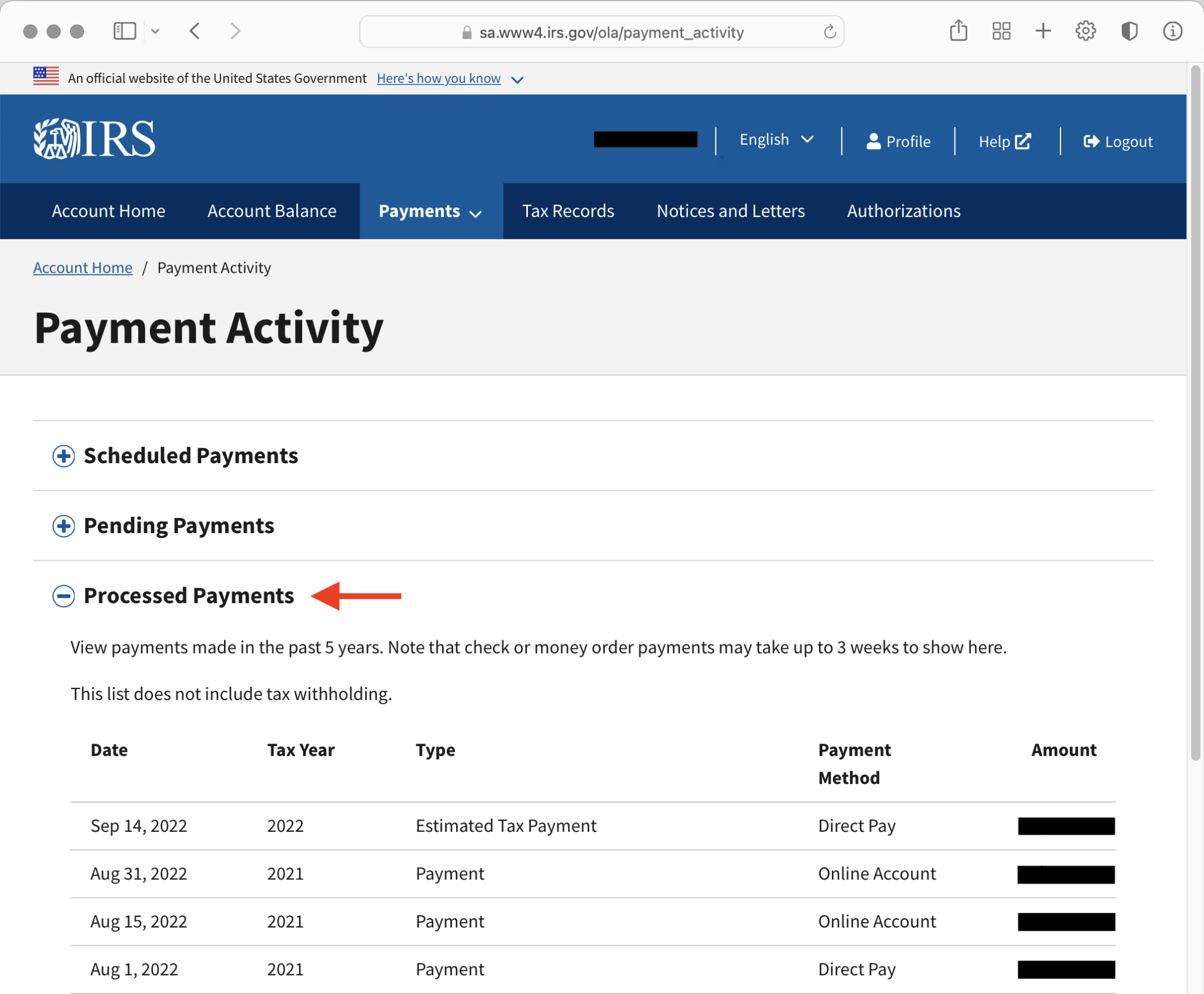

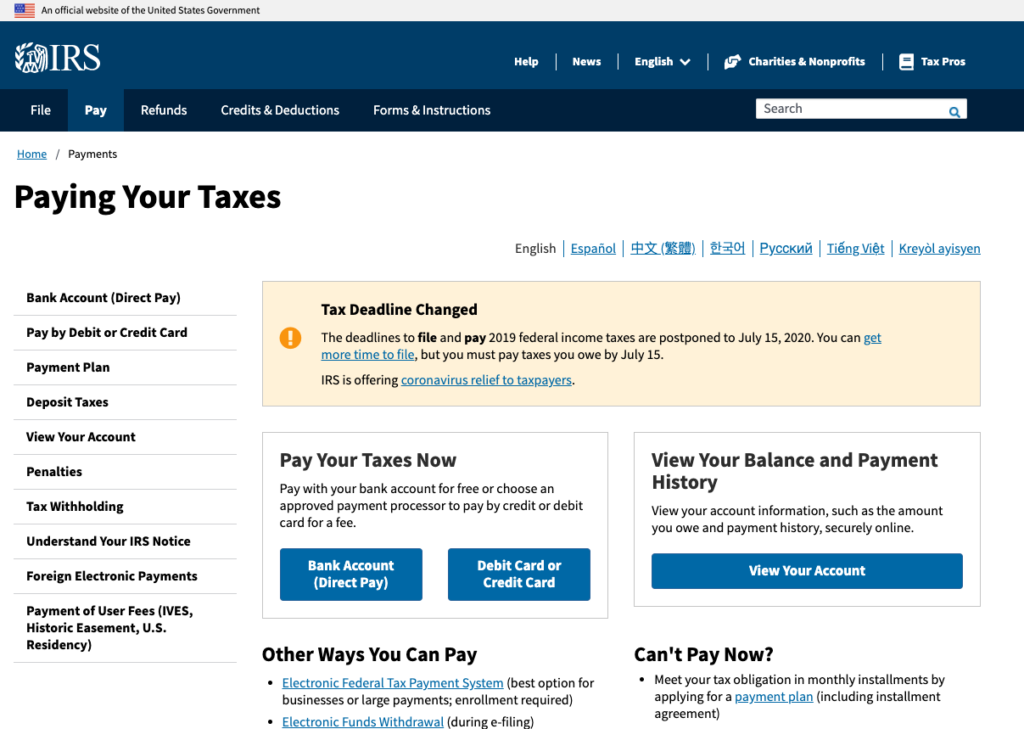

Paying taxes by debit, credit, or digital wallet is easy. Simply:

1. Visit the official government website or tax payment portal.

2. Select the payment option that suits you best (debit, credit, or digital wallet).

3. Enter your payment information and confirm the transaction.

4. Receive a confirmation receipt and payment acknowledgement.

Paying taxes by debit, credit, or digital wallet is a convenient, secure, and efficient way to meet your tax obligations. With the benefits of convenience, security, and flexibility, it's no wonder that more and more individuals are opting for these modern payment methods. So, next time you need to pay your taxes, consider using a debit, credit, or digital wallet option and experience the ease and convenience of online tax payment.

Note: This article is for informational purposes only and should not be considered as professional tax advice. Always consult with a tax professional or financial advisor for specific guidance on tax payment options.